Do you need an apostille on your IRS Form 6166?

Do you need an apostille on your IRS Form 6166?

Are you planning to work in another country and want to minimize or avoid double taxation?

At Apostille, Inc., we take the guesswork out of obtaining an apostille on your IRS documents.

Our trained and knowledgeable staff are available Monday-Saturday from 9am to 6pm to answer your questions and provide you easy to follow step-by-step instructions.

U.S. treaty partners require the IRS to certify that the company or person claiming treaty benefits is a resident of the United States for the federal tax purposes. The IRS provides this residency certification on Form 6166. This letter is typically referred to U.S. Residency Certification.

The most common countries we apostille IRS Form 6166 are for: Ukraine, Italy, Greece, Turkey, Portugal, Russia, Chile, and Kazakhstan.

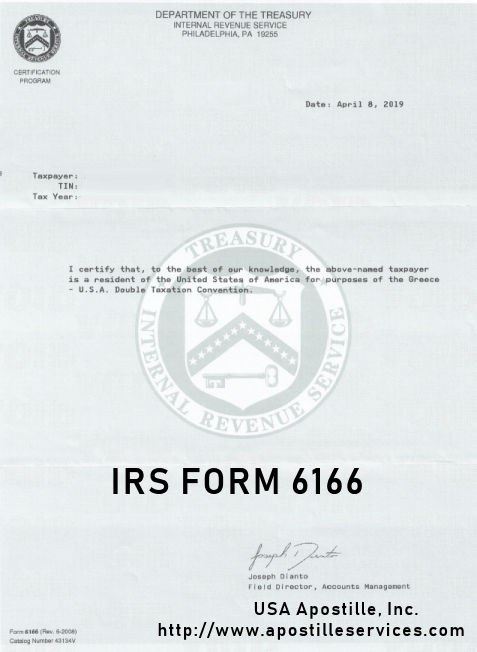

Form 6166 is a letter printed on U.S. Department of Treasury stationary certifying that the company or person is a resident of the United States for purposes of income tax laws of the United States. You may use this form to claim income tax treaty benefits and certain other tax benefits in foreign countries.

Here is an example of IRS Form 6166:

We can also process documents issued from all 50 U.S. states, District of Columbia, and the U.S. Federal Government. Do you have additional documents from another State? Click on your State to download the order forms.

Obtaining an apostille can be complicated. Don’t leave this process to untrained employees or non-professionals who do not fully understand the apostille process and the unique requirements of certain countries. Your paperwork could be rejected costing you time and money. Don’t let this happen to you!

Our staff is available Monday-Saturday from 9am to 6pm to answer your questions and provide you easy to follow-step-by-step instructions. Please call us at 1-800-953-3971.

Click on the download image to your left to get started. Our apostille service is fast, convenient, and saves you time and money.

Click on the download image to your left to get started. Our apostille service is fast, convenient, and saves you time and money.